A mortgage broker bond is a type of license bond required for residential mortgage brokers, lenders, or servicers. It acts as a financial guarantee to repay losses due to unethical or unlawful business practices on behalf of the broker.

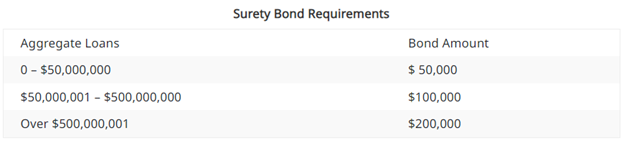

The bond requirements for California are listed in the California Residential Mortgage Lending Act (CRMLA). According to this act, the bond amount is “based on the amount of origination and/or servicing activities conducted by the licensee in the preceding calendar year.” The image below shows the bond amount requirements.

You can apply for a broker’s license through the Nationwide Multistate Licensing System & Registry (NMLS) website. You can also find licensing requirements specific to your state on this website.

How Quickly Can I Get the Bond?

In most cases the bond can be issued the same day it is applied for, but may take longer in some instances.

How Much Does It Cost?

The premium for each bond is determined by the bond amount required, as well as the credit score of the applicant. There is an additional underwriting requirement for mortgage broker bonds in the amount of $75,001 or more. You can contact us here for more information, or to request a quote.

What Will I Need?

To apply for a mortgage broker bond, you will need an application.

Contact us today and we can provide you with an application form, as well as answer any questions you may have. We’re here to help!